If you want to attain financial stability, you must learn how to create and adhere to a budget. In this post, we will give some recommendations to help you construct a budget that best suits your needs. There is no universal solution. Instead, you may need to go through a trial-and-error period to discover what leads to success.

Making a Budget: Steps to Follow

If you’re new to budgeting and managing your personal finances, here are some simple steps for creating a budget.

1. Determine Your Income

Finding out how much money you bring in is the first thing you need to do when creating a budget. To assist in producing an accurate estimate, it is helpful to compile pay stubs, tax forms from the previous year, and/or bank data. You should pay special attention to the amount of money that is left over after taxes have been deducted.

2. Detail Your Monthly Costs

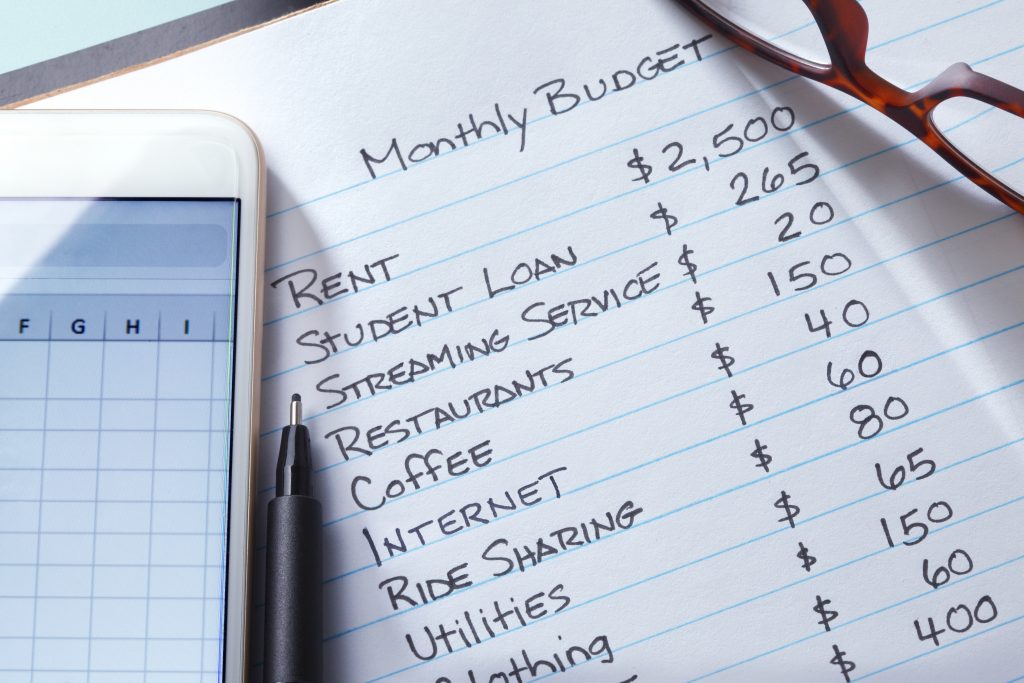

After that, make a list of all of your monthly expenses. As you make your list of expenses, be sure to indicate which ones are necessary and which ones are optional. Additionally, you should monitor how much money you set aside in your savings account. This may come in handy later on depending on the method of financial planning that you choose to implement.

3. Compare Your Income to Your Expenditures

Based on your income and expenditures, where are you overspending? Where can you reduce your expenses, and where must you make payments (rent/mortgage, loans, etc.)? Are there measures you may take to reduce your expenses? How much of your income is allocated to savings/debt reduction, essentials, and luxuries?

4. How to create a Budget Plan

When considering how to put together a personal budget, you have access to a wide variety of tried-and-true budgeting strategies, which you can use. Listed below are some ideas to consider:

Rule of 50/30/20 Budgeting

The rule of thumb for responsible budgeting, known as the 50/30/20 rule, suggests devoting fifty percent of one’s income to necessary spending and necessities. The remaining thirty percent is designated for satisfying your whims and desires, such as going shopping, subscribing to streaming services, or dining in restaurants. The remaining twenty percent is put into savings, in addition to the establishment of an emergency fund. If you already have money set aside for unexpected expenses, you can put this 20 percent toward retirement savings or paying down debt instead.

The Envelope Method

One of the most well-known names in the world of personal finance advice, Dave Ramsey, is one of the proponents of the envelope method of budgeting. After developing a financial plan, you proceed to pay for all that you can with cold hard cash. You put the cash into separate envelopes designated for its eventual use in various purchases.

If you estimate that you will spend $150 on groceries every week, for instance, you should place that amount of money in an envelope and bring it with you to the grocery store as your sole form of payment. This guarantees that you stay inside the confines of your financial plan.

Reevaluate Often

After implementing your budget, take sure to assess its progress. According to CNBC, 74% of individuals have a budget, yet 79% of them fail to adhere to it. In order to achieve financial security for yourself, you must do more than learn how to construct a budget; you must also assess whether it is functioning. Therefore, make adjustments as you go and continue your quest for potentially more effective approaches.